Breaking Down the Walls: A Series on Construction Delay – Delay Damages

This article was co-authored by Thomas Certo of Ankura

In the fast-paced world of construction, delays can pose significant challenges to project success. In this Breaking Down the Walls series, Gary Brummer, a partner at Margie Strub Construction Law LLP, and Jacob Lokash, an associate at the firm, draw upon their extensive legal expertise to explore the complexities of construction delays. They have collaborated with Thomas Certo, a senior director in the Construction Disputes and Advisory Group at Ankura Consulting Group, LLC, whose insights into the technical aspects of delay analysis provide a comprehensive perspective on this critical issue.

Together, they simplify the fundamentals of construction delays, providing readers with the necessary tools to proactively identify and assess delays on their own projects in Canada. At the end of this six-part series, we will have explored the following topics:Delay Claim Basics

- Delay Damages

- Disruption vs. Delay

- Concurrent Delay

- Forensic Schedule Analysis Techniques

- Construction Delay Best Practices in Canada

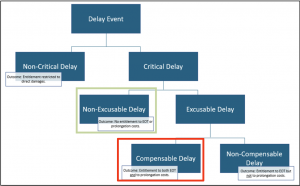

In Part 1, Delay Claims: Understanding the Basics, we introduced the concept of construction delay and discussed how delays on a construction project are generally classified as either critical or non-critical, excusable or non-excusable, and compensable or non-compensable. These classifications were summarized in the decision tree in Figure 1 below.

Figure 1 – Delay Claim Decision Tree

The decision tree concludes that a contractor’s entitlement to claim delay damages is generally limited to instances where there exists a delay which is critical, excusable, and compensable (identified by the red box in Figure 1, above).

Likewise, an owner (or owner’s representative) is generally entitled to claim damages for delay in instances where there is a critical, non-excusable delay (i.e., contractor caused delays that result in missing the agreed completion date) identified by the green rectangle in Figure 1, above.

In Part 2 of Breaking Down the Walls: Time is Money – Understanding Delay Damages, we focus on the damages that are often claimed as a result of critical, excusable, and compensable schedule delay.

Time is Money – Understanding Delay Damages

Delay damages, also referred to as ‘prolongation’ costs, are generally considered to be the time-related costs incurred because of delay to a project. In this article, we explore some of the key aspects of delay damages, including:

A. Distinguishing delay damages from discrete damages,

B. Typical contractor delay damage categories,

C. Typical owner delay damage categories,

D. Determining the period of time that delay damages should be quantified, and

E. The legal framework for claiming delay damages in Canada.

A. Distinguishing delay damages from discrete damages

One of the core principles in the Society of Construction Law’s Delay and Disruption Protocol (“SCL Protocol”) provides the following outline of what ‘prolongation’ costs (or delay damages) include:[1]

Unless expressly provided for otherwise in the contract, compensation for prolongation should not be paid for anything other than work actually done, time actually taken up or loss and/or expense actually suffered. In other words, the compensation for prolongation caused other than by variations is based on the actual additional cost incurred by the Contractor. The objective is to put the Contractor in the same financial position it would have been if the Employer Risk Event had not occurred.[2]

The SCL Protocol limits prolongation claims to those costs would make the parties “whole” had the delay event not occurred, unless otherwise stipulated in the contract. A fundamental characteristic of delay damages is that they are limited to the time-related costs actually incurred by the parties. The time aspect of delay damages will be discussed in more detail later in this article.

Delay damages can be contrasted from the additional, discrete costs directly attributable to a change in work or scope. Discrete damages are separate from delay damages and may be incurred whether the discrete impact results in delay. Therefore, if a discrete damage event does result in critical project delay, the delay damages should be assessed and put forth separately from the discrete costs, when possible.

This distinction can be illustrated by a simple example. Let’s say a design issue arises which is causing critical path delay to the project. To resolve the issue, the contractor’s project manager retains a specialist to evaluate the owner-issued design. The specialist’s time is not a delay cost – it is related to a discrete additional task – and should be claimed as a discrete cost. However, the project manager’s cost would be included in the delay damages as it is a time-driven expense. The project manager, as a dedicated project resource, is now required on the project for longer than planned because of the critical path delay. Using the same example, if the delay were not critical, the specialist’s time could still be claimed as a discrete damage claim, but the project manager’s time would not.

In summary, discrete damages are specific, not time related, and tied to individual events or impacts, whether or not there is a critical path delay to the project. Delay damages, on the other hand, capture the time-related impact of extended project durations. This article focuses on the latter: delay damages.

B. Contractor Delay Damages

Contractors and owners feel the financial pain of delay in different ways. In broad terms, a contractor’s pain is driven by committing resources to the project for longer than planned, and an owner’s pain is driven by the inability to utilize the constructed asset. It follows, then, that prolongation costs included in a contractor’s delay claim may differ from the prolongation costs included in an owner’s delay claim.

A contractor’s delay damages can materialize both on site (in the “field” or, “on-site”) and at the contractor’s home office (or “off-site”).

(i) Extended Contractor Field Costs

Under a typical construction agreement, the contractor is responsible for supplying the resources necessary to support construction. These costs are often referred to as “indirect” or “general condition” costs, and the agreement may even include a schedule outlining the monthly general condition expenses. If a compensable delay is encountered, a contractor may be entitled to claim for these extended general conditions. It is important to note that only time-related general condition costs should be included in a contractor’s delay claim – as opposed to discrete general condition costs.

When delays occur, general condition costs continue to accrue even if construction is stalled, resulting in added costs to the contractor. For example, rental payments for a site office trailer are time-driven, while contractor mobilization and demobilization are generally considered task-related, because they are incurred regardless of project duration.

While each project will have its own time-related costs, the following general condition cost categories are commonly included in a contractor’s delay claim:

- Project-specific field staff,

- Site office rental,

- Site maintenance,

- Site office equipment,

- Temporary utilities,

- General site equipment, and

- Project insurance.

A claim for general condition costs is often calculated as an “average daily rate” multiplied by the number of critical path days of delay.

(ii) Increased Contractor Direct Costs

Project delays can also result in increased direct costs, including labour, equipment, and material costs. When a contractor’s period of performance is shifted to a later time, there are several areas where increased costs may occur. These include:

- Standby time waiting to proceed on a delayed work front,

- Storage/warehousing costs for procured materials which cannot be installed,

- Price escalation associated with inflation, market changes, or union agreements, and

- Non-availability of specialty subtrades, equipment, or materials which require a more expensive substitute or replacement.

Many contracts include a clause requiring a contractor to mitigate its damages while delayed, such as standing down trades or resequencing work. However, these additional costs may be unavoidable depending on the project and circumstances. For example, projects delayed in the COVID-19 pandemic highlight these escalation costs.

As the construction industry has seen, the COVID-19 pandemic significantly disrupted global supply chains, leading to widespread shortages, shipping delays, and unprecedented price escalations for materials and labor. These disruptions have impacted construction projects around the world, compelling contractors to navigate a volatile market where costs can fluctuate dramatically. Depending on the contractual provisions and factual circumstances, these cost fluctuations have been claimable in certain instances.

To successfully claim for such price escalation, parties must demonstrate that there is a causal link between the delay and the increased costs. Quantification of the associated damages is fundamentally a comparative exercise, where documentation is critical to the success of a contractor’s claim. Simply, records related to bid pricing, price changes, supply chain disruptions, and supporting communications, can make or break a claim.

As a final comment on increased direct costs, contractors often submit delay claims which include alleged cost impacts from lost labour productivity. While some productivity losses may be linked to project delays, these claims are typically treated separately from quantification of delay damages. We will cover this topic in Part 3 of this Breaking Down the Walls Series: Delay vs. Disruption.

(iii) Extended Home Office Overhead

A contractor typically maintains a “home office” away from site which incurs its own operational costs to support the project. These off-site operational expenses are not specifically related to one project and include items such as rent, management and administrative staff, marketing, and other costs which allow the home office to function and support the contractor’s portfolio of projects.

Home office overheads can be categorised as dedicated overheads or unabsorbed overheads. Diligent contractors may, through careful record keeping, allocate certain costs or time to a specific project or even delay event.[3] In such instances, it may be possible to accurately apportion these costs to quantify delay damages, leading to a straightforward claim calculation. However, where these records are not available, contractors often rely on an estimation of the unabsorbed overhead amount associated with a specific project.

The entitlement and methodology for quantifying a contractor’s claim for home office overheads, particularly through use of a formula, are debated topics in the industry. On entitlement, the SCL Protocol recommends that a certain burden of proof lies with the contractor to show that the contractor was unable to pursue other work because of the delay:

If the Contractor intends to rely on the application of a formula for the assessment of lost profits and unabsorbed head office overheads, it will first need to produce evidence that it was unable to undertake other work that was available to it because of the Employer Delay. These records may include the Contractor’s business plans prior to the Employer Delay, the Contractor’s tendering history and records of acceptance or rejection of tender opportunities depending upon resource availability.[4] [emphasis added]

Apart from entitlement, unabsorbed head office overheads can often be difficult to calculate, particularly in large corporations with numerous active projects that are being constructed simultaneously. There is simply no standard methodology appropriate for every claim situation. For this reason, various formulae have been developed as quantification tools to estimate a contractor’s loss. The SCL Protocol prefers use of the Emden and Eichleay formulae.[5]

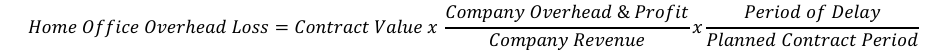

The Emden formula, commonly used in the UK, calculates a contractor’s overhead losses as a proportion of the contract amount during the planned period of performance. This formula is based on the contractor’s historical average overhead and profit margin,[6] which is applied to the contract amount. The Emden formula can be defined as:

Take for example a $1M contract which had an original duration of 100 days, with 25 additional days of compensable delay. If the contractor’s overhead and profit that year was $500k on a total business revenue of $5M, the contractor’s overhead compensation under the Emden formula would be $25K.[7]

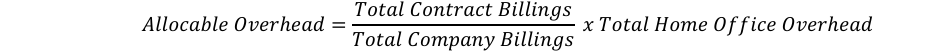

In contrast, the Eichleay formula, commonly used in the US, is based on the contractor’s home office effort during the actual period of delay for the project in question rather than its historical performance. This approach tends to provide a more precise estimate of the home office loss from a delay, but also requires more precise financial records. This calculation can be summarized in three steps:

Step 1 – Determine the allocation of contract billings to overall company billings during the contract period of performance:

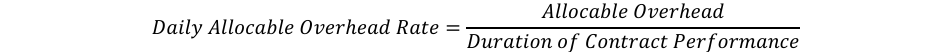

Step 2 – Determine the daily allocable overhead rate using the period of contract performance (including delays):

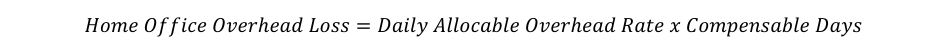

Step 3 – Determine the estimated home office overhead loss during the compensable delay:

Using the same example project as above, the Eichleay formula results in an estimated $20k in home office overhead losses for the same delay, or 20% lower than when using the Emden formula.[8]

Although courts in Canada have accepted use of both the Emden and Eichleay formulae, a contractor should be prepared to prove that the delay caused a loss, and that the loss could not be mitigated.

This article speaks to the Emden and Eichleay formulae, but other formulae have been successful in asserting and defending claims for damages such as the Manshul and Hudson formulae. The authors are not endorsing any specific formula as best, because the formula selection is ultimately dependent on specific project facts and availability of information. That said, consulting with experienced legal counsel and quantum experts will help a contractor put their strongest claim together based on the facts at hand.

C. Owner Delay Damages

If a forensic delay analysis concludes that the contractor caused a non-excusable delay, the owner may be entitled to claim delay damages from the contractor. These damages can be outlined in the contract as liquidated damages, or they can be quantified discretely based on the actual damage suffered.

(i) Liquidated Damages

Owners often pre-estimate their delay damages in the form of liquidated damages, which are reflected as a fixed amount payable for each day (or some other unit of time) past the contractually agreed project completion date. In Canada, liquidated damages are deemed enforceable where they represent a genuine pre-estimate of the damages an owner will likely suffer because of delay caused by another party. Where it is apparent that a liquidated damage amount is excessive and objectively unreasonable, the courts may declare it a penalty and therefore unenforceable.

Because liquidated damages are a predetermined amount, a savvy contractor may evaluate its own costs against the liquidated amount to understand the cost-benefit of mitigating a non-excusable delay. In this way, liquidated damages are not a deterrent to contractor delay, but rather a contractual vehicle for the owner to recover its estimated losses.[9]

In the absence of a liquidated damages clause, or if the liquidated damages expire after a certain number of delay days, an owner may be entitled to recover its actual delay damages. The contract will typically outline the owner’s and contractor’s rights to claims and damages.

(ii) Actual Owner Delay Costs

An owner’s delay damages are typically based on losses incurred from restricted use and enjoyment of the constructed asset, which may include:

- Storage costs,

- Additional or lost rental income,

- Extended project staff,

- Temporary lodging/space,

- Additional financing costs,

- Damages claimed by follow-on contractors, and

- Lost revenue of profits.